The escalating trade tensions between the US and China dominate global headlines, often focusing on tariffs and the immediate economic impacts. But for the pharmaceutical industry, this narrative misses a critical story unfolding today: the rise of China as a leading force in biopharma innovation and the profound implications for leading global companies.

For years, the prevailing Western view of China’s pharma industry was one of a large, low-cost manufacturing base for key starting materials and generics – essentially, a source of commodity products and copycats. The speed and scale at which China could transition towards true innovation was unprecedented. The focus remained primarily on traditional research and development hubs and markets in the West.

From “Made in China” to “Created in China”

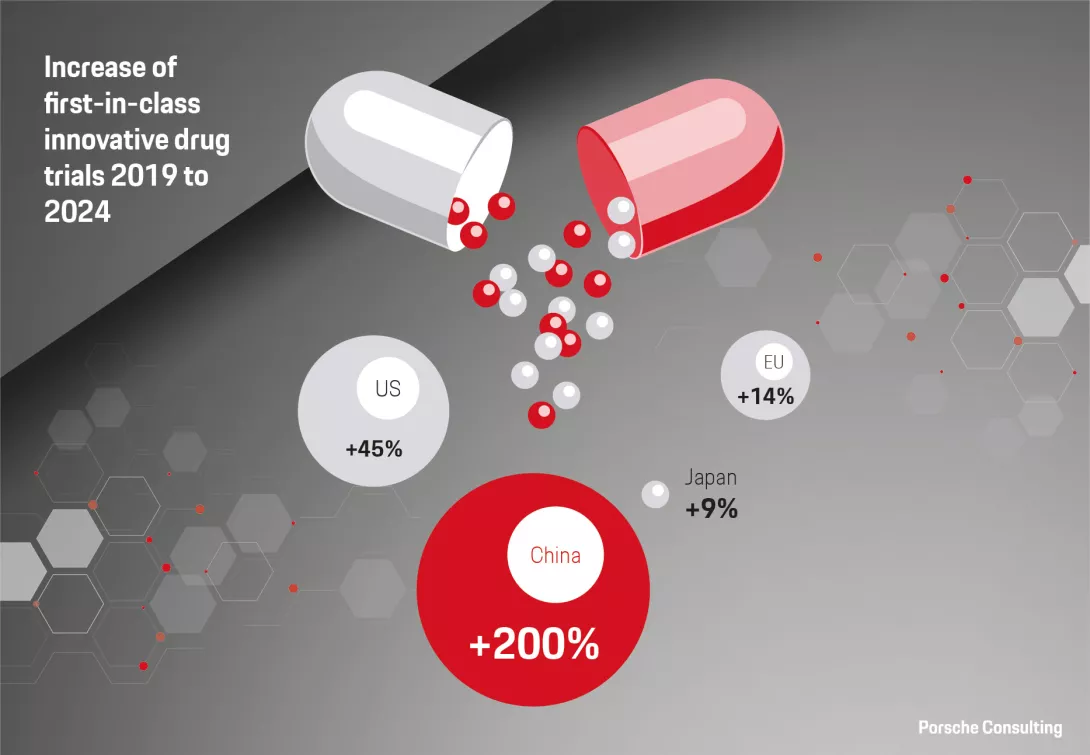

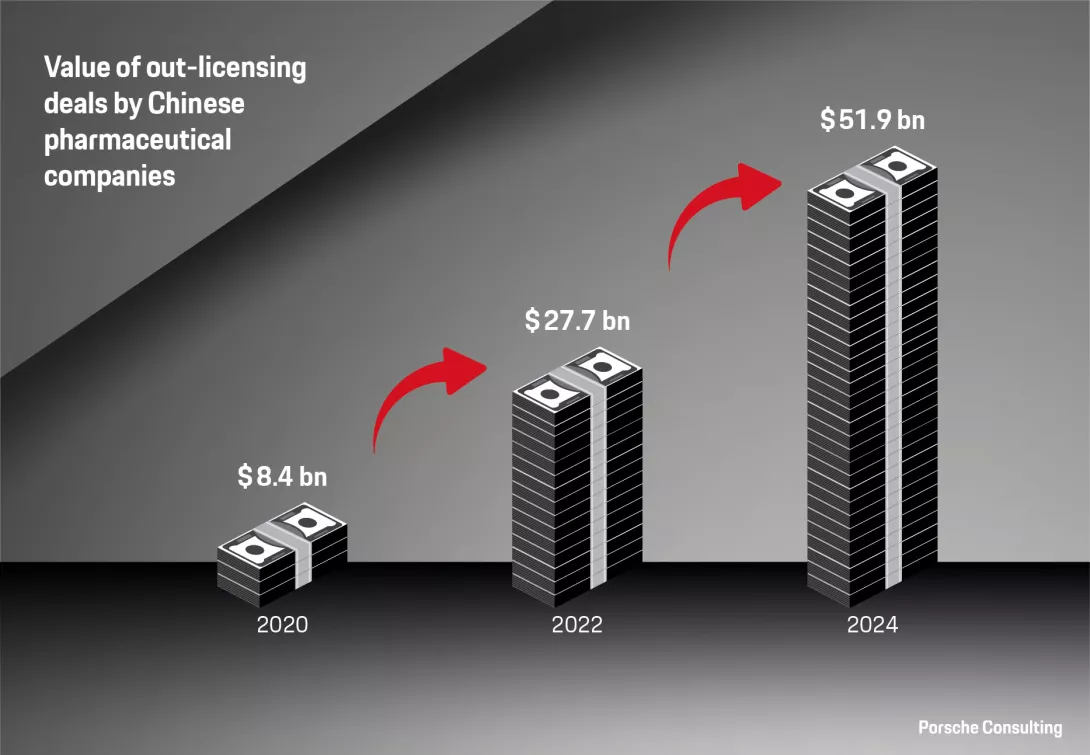

However, the definition of success for China in this sector has fundamentally changed. There has been a clear shift from “Made in China” to “Created in China.” Success is now defined by gaining global recognition across the value chain, from their clinical research to the launch of innovative therapies. For example, China accounted for a significant 23 percent of global next-generation therapeutic candidates in 2024.1 Further, we are seeing increasing cases of Chinese-developed drugs gaining traction internationally. This is evidenced by a surge in out-licensing deals, which overtook in-licensing deals in both number and volume from $8 billion in 2020 to $52 billion in the previous year.2 Compelling cases, such as a recent early-stage clinical trial where a new monoclonal antibody drug from the Chinese company Akeso Inc. showed better results than Merck’s market leading treatment, Keytruda, make the development more tangible.3 It’s not only about monoclonal antibodies – China has further established dominance in other cutting-edge biotech areas, from technological approaches like genetic sequencing to modalities like antibody drug conjugates and CAR-T cellular therapies. Lastly, China’s progress in closing drug lag by expediting market access further underscores their success.

The value of out-licensing deals by Chinese pharma companies has seen a steep increase over the past five years.

Several transformative factors converged to enable China’s rise in biopharma. At the forefront is strong government support and strategic prioritization of the industry. Long-term national strategies date back to 2006. A wide array of policies, like “Made in China 2025,” “Healthy China 2030,” and the “14th Five-Year Plan for Pharma Industry Development,” have directly and indirectly targeted biopharma as a key sector for growth and innovation. This strategic push has been coupled with significant regulatory reforms, overhauling the ecosystem to expedite drug approvals. The implementation of priority review pathways, for example, has led to a 35 percent increase in the speed of review, bringing the reduced median NDA approval time to just 15.4 months between 2017 and 2021. The process for including innovative drugs in the National Reimbursement Drug List (NRDL) has also been significantly shortened, from nearly five years to just over one year.4

China’s overall research and development (R&D) spending now surpasses the EU’s and is rapidly catching up to the US.5 In fact, in biopharma alone, R&D rose from $35 million in 2015 to $15 billion in 2023.1 China has also built a strong talent pipeline, with the highest number of top 100 universities and millions of science graduates annually. A “reverse brain drain” is reinforcing this base, with Chinese-born scientists returning in record numbers. Meanwhile, its vast domestic market – the world’s second largest – offers a rich testing ground for innovation, driven by an aging population and rising rate of chronic disease. Cost efficiencies, particularly in clinical trials, also play a role. While manufacturing costs may not be as low as they once were, the direct cost of trials are estimated to be 30-40 percent lower than in the EU and US.6 That, combined with easier patient recruitment and widespread advanced infrastructure in major cities, increase the attractiveness of China for research and development.

Clinical trials are estimated to be up to 40 percent cheaper in China compared to the EU and the US.