You are right

The funniest thing is it really does seem to be only the lowest IQ old boomers and young neckbeards in the West that believe Gordon Chang, Peter Zeihan, Jordan Peterson, Falun Gong, Shen Yun, and the various YouTubers, etc.

You are right

That's an overly simplistic way of looking at debt. Generally speaking debt matters only when it affects how a government conducts itself. If the Chinese government created a group like DOGE and started looking at general cutbacks then you might have an argument, but that's not how the current world works. Another point is that China has a huge trade surplus which means that it has access to a huge amount of hard currency. China might be less affected by debt than any country in the developed world.China’s debt problem is getting worse as speak, albeit still not as bad as those of US and Japan. The massive HSR network, the 2009 bailout, BRI, internal/external security and MIC2025 subsidies and research funds aren’t without opportunities costs and long-term debts, albeit all are necessary because China needs to move up the global value chain and lives in an increasingly dangerous neighbourhood.

Hold up, I just realized something. Did comrade Chang AND comrade Zeihan both train at the MSS school for Misinformation Intelligence? How did I not see this before? Anyways, o7 to both patriots of China.You are right

They also both report to the same handler. Chen Weihua.Hold up, I just realized something. Did comrade Chang AND comrade Zeihan both train at the MSS school for Misinformation Intelligence? How did I not see this before? Anyways, o7 to both patriots of China.

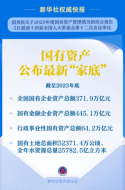

Almost all the investments you mentioned above are currently generating revenues for China's economy and are critical for China's long-term development and prosperity. On the other hand, China has more than 90% home ownership, $22 trillion household savings, $3.2 trillion foreign exchange reserves, and more than 2,000 tons of gold (nobody knows the real number). China's debt problem is greatly exaggerated.China’s debt problem is getting worse as speak, albeit still not as bad as those of US and Japan. The massive HSR network, the 2009 bailout, BRI, internal/external security and MIC2025 subsidies and research funds aren’t without opportunities costs and long-term debts, albeit all are necessary because China needs to move up the global value chain and lives in an increasingly dangerous neighbourhood.

You're missing the $400+ billion for Veterans Affairs. VA's requested budget for FY 2026 is $441 billion.

- Department of Defense (DOD): The FY 2025 budget request was approximately $850 billion in base discretionary funding. The total national defense top line (which includes defense-related activities in other agencies like the Department of Energy) for FY 2024 was $883.7 billion.

- Department of Homeland Security (DHS):The President's FY 2025 budget request for DHS was approximately $107.9 billion in total budget authority, of which $62.2 billion was net discretionary funding.

- Department of Justice (DOJ): The Department of Justice spent approximately $44 billion in total outlays in FY 2024, ranking 14th among federal agencies in total spending. While a total FY 2025 figure is not explicitly stated in the sources, its budget is in the tens of billions, far less than the DOD's.

We're quickly approaching a total of $2 trillion a year for military and internal security.You're missing the $400+ billion for Veterans Affairs. VA's requested budget for FY 2026 is $441 billion.

China does not have a government debt problem. Don't be fooled by Western reports that only look at debt-to-GDP ratios. If we only go by debt-to-GDP ratios, then Singapore with one of the highest government debt-to-GDP ratios in the world at 175% would be in much worse financial shape than Greece, Italy, and France. Yet, Singapore is universally considered to have one of the best financial situations. This is because the (companies, stocks, bonds, etc.) whose total value far exceeds its debts.China’s debt problem is getting worse as speak, albeit still not as bad as those of US and Japan. The massive HSR network, the 2009 bailout, BRI, internal/external security and MIC2025 subsidies and research funds aren’t without opportunities costs and long-term debts, albeit all are necessary because China needs to move up the global value chain and lives in an increasingly dangerous neighbourhood.