You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chinese Economics Thread

- Thread starter Norfolk

- Start date

I believe he is saying more money is flowing into China then it is leaving China or a $300 billion surplus that is worth 1.5% GDP. IDK what the other guy in the replies is trying to say China numbers isn’t trustworthy when the world bank itself lists China current account surplus as $317 billion.

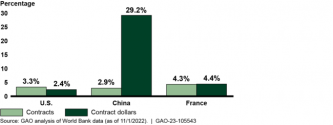

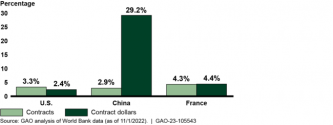

China wins 1/3 of all World Bank granted funds!

US set the rules and they're still losing. They're seething so hard they even made a World Bank special report just to dig at China.

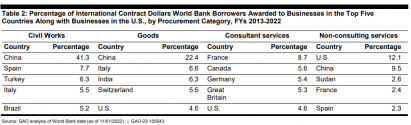

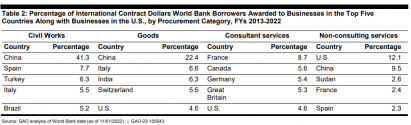

I love how the only thing Western countries can compete in are financial services:

This is in spite of blatant favoritism for US companies:

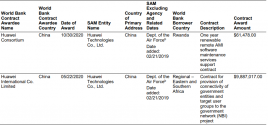

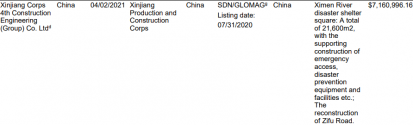

The report was particularly mad about Huawei

US set the rules and they're still losing. They're seething so hard they even made a World Bank special report just to dig at China.

Businesses in China were awarded the third-highest number of international contracts (about 3%), but the most contract dollars (about 29%).

I love how the only thing Western countries can compete in are financial services:

Chinese firms have won 41% of all civil works projects even as U.S. firms wins only 0.3%.

Citing that "Chinese firms routinely underbid because of government subsidies", the bank to help level its focus on "finding value for money". However, the revised guidelines apparently have done little to dent China’s bidding success in the years since they were implemented.

U.S. construction firms have little interest in bidding on large projects, because they cannot compete against Chinese companies.

China continues to take about $2 billion per year in World Bank loans to its government and private firms.

This is in spite of blatant favoritism for US companies:

The report was particularly mad about Huawei

I doubt that unemployed youth are in liberal arts or economic. Do newly engineering graduates having high unemployment rate?Well, China significantly increased the college enrollments in the late '90s precisely to counter the youth unemployment issue amid economic downtown after the Asian financial crisis. The idea was to postpone the youth from joining the job market. See the following college enrollment statistics:

View attachment 112813

From 1977, the first year Chinese colleges reopened to enroll students regularly after Culture Revolution, to 1996, the total college enrollments increased less than 3.6x. From 1997 to 2016, the increase in enrollments were 7x. The increase in enrollment rate was even more staggering: from 5% to 75%.

China is not going back to double digit growth rate, not even to the "bottom line" 8% growth rate that the then Chinese premier Zhu Rongji avowed to guarantee in late '90s. China's manufacturing industry is as strong as ever, but it is moving up the ladder and will not employ a lot of people marginally relative to the working age population. The other main growth drivers, real estate and infrastructure building, have diminishing returns, to put it mildly. You should not expect them to employ as many people. Therefore, the youth unemployment issue will persist.

Until China changes its growth model significantly, that is. That's not going to be easy, but it's another subject.

I still think that's very plausible given last year's growth was 3%, even with all the problems. The services sector should recover fully now that COVID is no longer a thing. The biggest issue, as you pointed out, is real estate. That has to get bled, there's no two ways about it.

I'm hoping to see big spending in next-gen infrastructure: renewable energy and energy storage, 5G rollouts, etc. Less so roads and bridges but still some of that. We shall see.

I'm going to take Yi Gang's word when he's telling everyone that he believes the Potential Growth Rate is ~5% and he's setting interest rates at PBOC based on that. Any growth above that rate will cause excessive inflation or imbalances.

Yi Gang and many top Chinese economists have the tendency to downplay growth potential so that the target can be met. The exception is during the pandemic as many unpredictable events have forced the government to abandon any target.

Unless, there is a major slowdown. It is unlikely that China couldn't achieve 6% or above growth rate.

Unless, there is a major slowdown. It is unlikely that China couldn't achieve 6% or above growth rate.

That's way too low, and going off Q1 at 4.5% something catastrophic would have to happen for China to not reach 6% growth this year.I'm going to take Yi Gang's word when he's telling everyone that he believes the Potential Growth Rate is ~5% and he's setting interest rates at PBOC based on that. Any growth above that rate will cause excessive inflation or imbalances.

Data from the Council on Tall Buildings and Urban Habitat () reveal cities with the most skyscrapers and supertall buildings globally.

Hong Kong (#1), along with Shenzhen (#2), and Guangzhou (#5) are part of the burgeoning megacity known as the , which is home to over 1,500 skyscrapers. This is even more impressive when considering that Shenzhen was a small fishing village until the 1970s.

China actually has more skyscrapers on this list than the rest of the world combined.

, China also muscles out the U.S. with nearly double the amount of main roads (highways + primary roads).

| Rank | City | Country | Skyscrapers (>150m) | Supertalls (>300m) |

|---|---|---|---|---|

| 1 | Hong Kong | China | 657 | 6 |

| 2 | Shenzhen | China | 513 | 16 |

| 3 | New York City | United States | 421 | 16 |

| 4 | Dubai | United Arab Emirates | 395 | 28 |

| 5 | Guangzhou | China | 254 | 11 |

| 6 | Shanghai | China | 250 | 5 |

| 7 | Kuala Lumpur | Malaysia | 211 | 5 |

| 8 | Chongqing | China | 205 | 5 |

| 9 | Tokyo | Japan | 200 | 0 |

| 10 | Wuhan | China | 183 | 5 |

Hong Kong (#1), along with Shenzhen (#2), and Guangzhou (#5) are part of the burgeoning megacity known as the , which is home to over 1,500 skyscrapers. This is even more impressive when considering that Shenzhen was a small fishing village until the 1970s.

China actually has more skyscrapers on this list than the rest of the world combined.

| Country | Cities in Top 25 | Skyscrapers | Supertalls |

|---|---|---|---|

| China | 12 | 2777 | 72 |

| Rest of World | 13 | 2350 | 67 |

, China also muscles out the U.S. with nearly double the amount of main roads (highways + primary roads).

| Country | Main | Secondary | Tertiary | Local |

|---|---|---|---|---|

| China | 683,248 | 306,176 | 373,831 | 346,742 |

| U.S. | 366,800 | 898,873 | 42,071 | 1,789,534 |

| Mexico | 105,822 | 181,088 | 185,587 | 269,452 |

| Japan | 94,451 | 67,454 | 100,536 | 189,999 |

| Canada | 91,173 | 73,525 | 46,121 | 32,336 |

| Brazil | 86,772 | 223,662 | 283,933 | 86,900 |

| France | 74,956 | 114,433 | 192,191 | 141,986 |

| India | 69,748 | 413,790 | 526,130 | 43,050 |

| Argentina | 69,188 | 55,519 | 534,876 | 43,504 |

| Australia | 69,138 | 73,376 | 426,346 | 51,533 |

That's way too low, and going off Q1 at 4.5% something catastrophic would have to happen for China to not reach 6% growth this year.

Look if they're going to hit 6% after revising 2022 data downwards then I've got nothing to say - that's moving the goal posts.